23 Oct 2025

To deepen the integration between classroom learning and industry practice, on October 14, 2025, David Ni, Partner of Tax and Business Advisory at Deloitte China, was invited to deliver a guest lecture titled “An Overview of International Tax Rules and Tax Treaties” for the Year 4 course ACC307 Advanced Taxation at International Business School Suzhou (IBSS), Xi’an Jiaotong-Liverpool University. The lecture, part of the ACC307 curriculum taught by Dr Liyan Hou, was initiated and coordinated by IBSS Work Placement, Employability, Career Development Team (IBSS WEC) to strengthen the bridge between academia and industry practice.

David Ni speaking during the lecture

The session began with welcome remarks from Dr Peng Cheng, Head of the Accounting Department at IBSS. He noted that the audience included not only accounting majors but also students from economics, finance, and business analytics programmes. “Taxation has gone far beyond accounting,” Dr Cheng said. “It has become an essential competency for future leaders engaged in business management and strategic decision-making.” He also extended special thanks to Lisa Cheng, HR Manager of Deloitte Suzhou, for her dedicated coordination and continued support. As a long-serving external mentor of XJTLU, Lisa has been a key contributor to the university’s partnership with Deloitte in talent development and academic collaboration.

Dr Peng Cheng

With more than 17 years of experience in tax advisory and management consulting, David guided students through the complexity of international tax systems from a global perspective. He discussed variations among national tax regimes, the concept of tax jurisdiction, and the resulting cross-border tax conflicts. He further elaborated on how double taxation can be avoided through deduction, credit, and exemption methods, emphasizing the role of tax treaties in maintaining fairness and efficiency in international taxation.

In illustrating the application of tax treaties, David analyzed a real-life case from Jiamusi, helping students clearly see how theoretical concepts are applied in real-world scenarios.

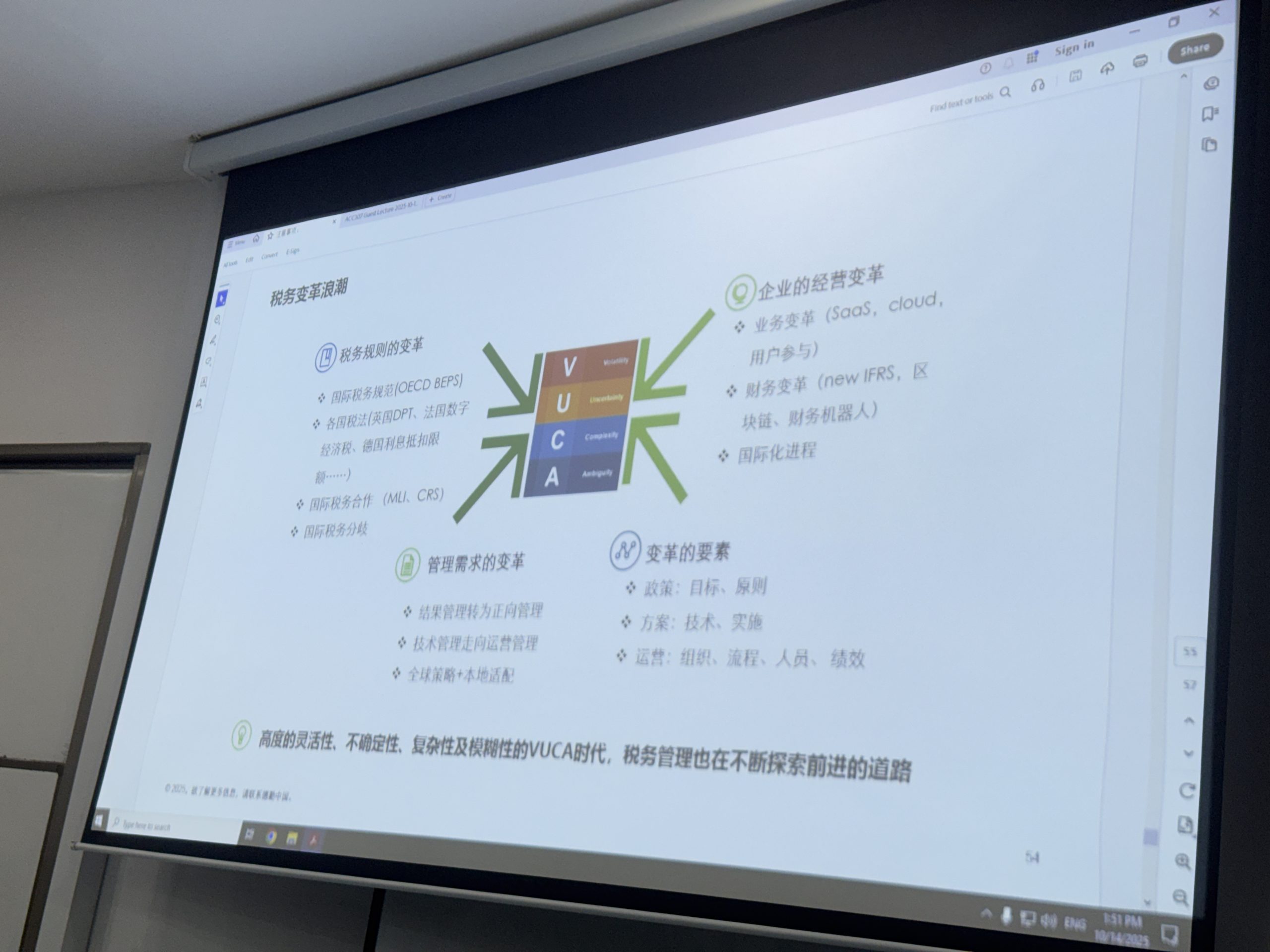

In the second half of the lecture, David shared his insights on the “Waves of Tax Transformation”, highlighting four key dimensions:

1) Evolution of tax rules – including international standards, domestic legislation, cooperation, and divergence across jurisdictions;

2) Changing management needs – as digitalization and compliance reshape corporate tax management;

3) Core elements of transformation – balancing policy design and operational implementation;

4) Enterprise-level changes – spanning business restructuring, financial optimization, and tax planning in global expansion.

These insights enabled students to realize that taxation is not merely a technical issue, but a critical component of corporate strategy in a globalized economy.

During the interactive Q&A session, students raised questions about how to keep pace with changing tax regulations, core skills for tax advisory roles, and career and further study options. Lisa Cheng, HR Manager of Deloitte Suzhou, and Yidan Liu from IBSS WEC team shared their professional insights.

Lisa explained Deloitte’s new brand positioning — “Together makes progress” — and detailed the firm’s comprehensive career development system, which provides full-cycle support for employees at different stages: from onboarding and professional training to career advancement and partnership preparation. Yidan encouraged students to build the courage to make independent career decisions, to explore new possibilities from the ground up, and to align choices with their own strengths and values.

Dr Lingyan Zuo, Programme Director of the BA Accounting programme, concluded the session by noting that David’s practical insights enabled students to better understand how theoretical knowledge underpins the analysis and resolution of real-world tax challenges. She encouraged students to stay attentive to industry developments, apply theory flexibly, and integrate academic learning with practical understanding to navigate complex business environments.

The success of this lecture once again demonstrated IBSS’s commitment to practice-oriented education and industry collaboration. As one of the world’s leading professional services firms, Deloitte continues to contribute to talent development, higher education partnerships, and the co-creation of academic and industry resources. Looking ahead, IBSS will continue to collaborate with Deloitte and other industry leaders to provide students with more opportunities to engage with real-world business practice, enhance practical skills, and strengthen their career competitiveness.

About the BA Accounting Programme

The BA Accounting programme at XJTLU equips students with international perspectives, analytical thinking, and practical accounting skills. Students study key areas such as financial accounting, auditing, and taxation, while also developing strategic planning, leadership, and professional ethics. Graduates may receive multiple exemptions from globally recognized accounting bodies, including ACCA, ICAEW, and CIMA, building a strong foundation for both advanced studies and professional careers.

Special thanks to:

XJTLU External Mentor Professional Committee of IBSS – Commerce

XJTLU Career Centre

XJTLU Student Development Advice Centre (SDAC)

23 Oct 2025