24 Aug 2023

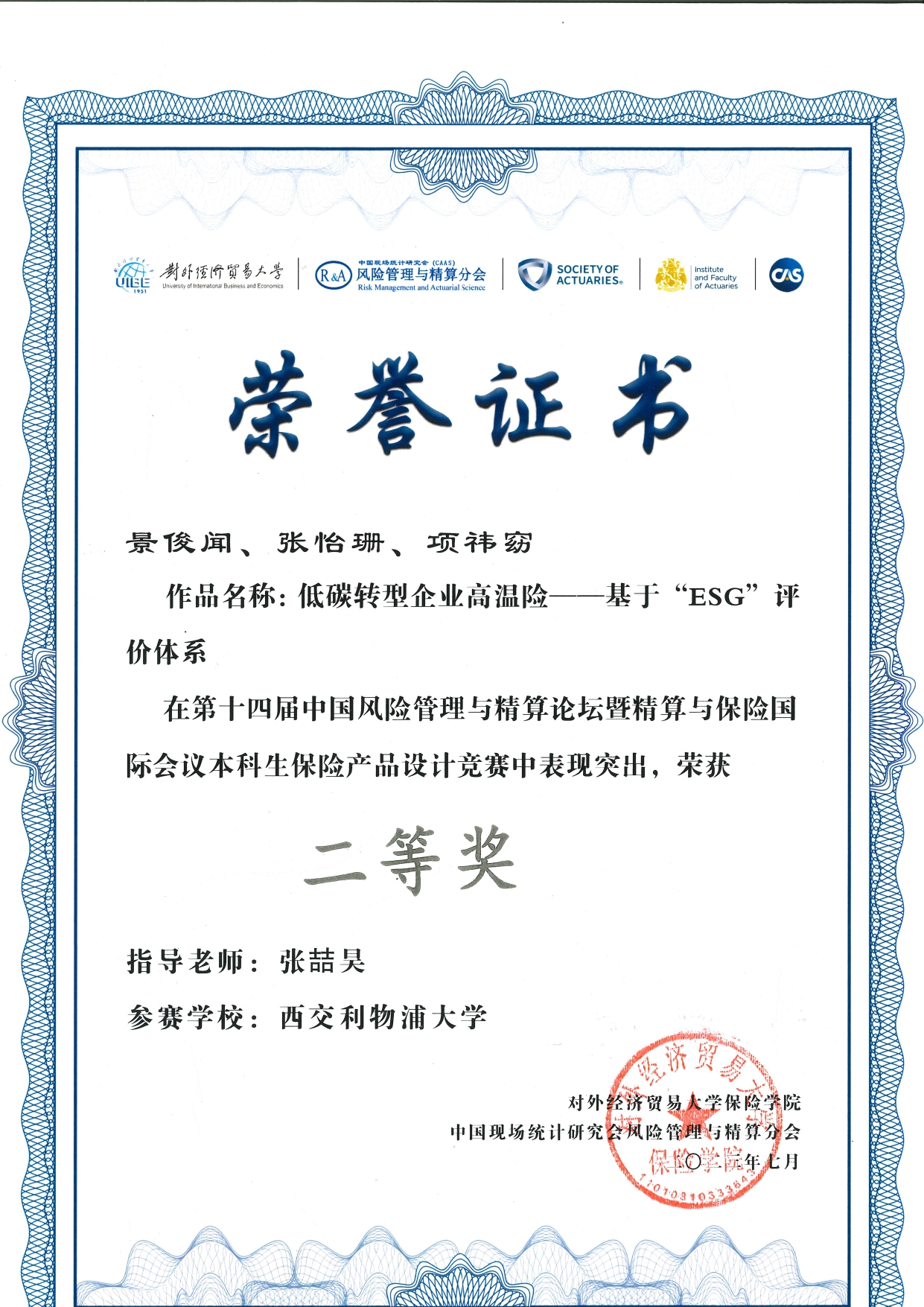

Recently, teachers and students from XJTLU went to the University of International Business and Economics (UIBE) to participate in the 14th China Forum for Risk Management and Actuarial Science & International Conference on Actuarial and Insurance, winning the second and third prizes in the Undergraduate Case Study Competition out of 39 undergraduate teams.

From left to right: Yuhao Wu、Dr Zhehao Zhang、Junwen Jing

Renmin University of China and 14 other universities jointly held the "Chinese Risk Management and Actuarial Science Construction Seminar" in March 2010. They decided to organise the" China Forum for Risk Management and Actuarial Science " further to strengthen China's risk management and actuarial research and promote the innovation of academic exchanges and talent training models.

This year, the 14th China Forum for Risk Management and Actuarial Science & International Conference on Actuarial and Insurance is hosted by the University of International Business and Economics and the Risk Management and Actuarial Branch of China Field Statistics Research Association, with the participation of more than 200 experts and scholars from home and abroad in the fields of politics, enterprises, academia and research.

Source: University of International Business and Economics

Professor Hailiang Yang, from the Department of Financial and Actuarial Mathematics, was invited to give a speech entitled “Deep Learning in Actuarial Science: Introduction and Applications” on the method for optimising insurance strategy.

Students from XJTLU fully engaged in the insurance product design competition of the forum, exchanging ideas and learning with outstanding students from top universities across China.

Taking part in this competition and exchanging ideas, according to Dr Zhehao Zhang, the student team's instructor, is a good opportunity to help students better understand their future career paths, increase their interest in actively participating in the research of insurance design, and strengthens their capacity to innovate in the application of insurance. It fully reflects that the School of Mathematical Physics implements a student-oriented teaching philosophy.

Slightly different from property insurance in traditional operation, the second prize-winning student team chose to design profit insurance for enterprises in property insurance.

Junwen Jing, a student team member, explains: “Our team worked on the issue of increased costs to enterprises caused by extreme weather. These costs cover four main aspects: energy costs, equipment maintenance costs, employee high-temperature subsidy costs, and carbon emission costs. We have deeply considered factors such as the size of the company, its industry and geographical location, all of which can affect payouts. Therefore, we have adopted a tiered rate method to determine the cost, combined with the ESG score and performance of the insured company, to reduce the risk of adverse selection.”

"I have a thorough awareness of the entire process of insurance products, from conception to implementation, which is my greatest benefit from participating in this competition. Through this experience, I improved my professional abilities while learning more about the insurance sector.

The student team that won the third prize chose the topic“Green Bond Umbrella, Sustainable Security Shield—Green Bond Protection Insurance”. The team launched the Green Bond Protection Insurance because green bonds, which are currently popular in the market but may bring greater risks to investors, aim to reduce the losses caused by defaults of green bonds.

The primary focus of the insurance products we create is their cost. We eventually created insurance by analysing a few past databases and the probability of default for a few companies and integrating the green creditor's rights and the company's own ESG ratings to provide them with varied pricing levels. This innovative idea raises insurance firms' and issuers' ESG ratings while boosting investors' confidence in green bonds. remarked Yuhao Wu, a member of the student team.

“Our team also learned a lot of new knowledge in calculating the probability of default, such as the Merton model, KMV model and many other calculation models. This competition has deepened my understanding and learning of the insurance pricing system and helped me improve such abilities as withstanding pressure, teamwork and on-the-spot reaction.”

“This competition has stimulated the innovation enthusiasm of the student team and enriched the platform for student innovation and practice. Congratulations to the award-winning students, and I look forward to another success for our students in the next Forum for Risk Management and Actuarial Science.” Dr Zhehao Zhang said.

The two winning teams consisted of Junwen Jing, Yishan Zhang and Yiyao Xiang, Yuhao Wu, Yufei Zou and Yinuo Du, who are sophomores majoring in Actuarial Science from the School of Mathematics and Physics. XJTLU School of Mathematics and Physics supported the competition financially and academically, and technically guided by KPMG Advisory (China) Limited.

By Qinru Liu

Translated by Yi Chang Wang

Edited by Qinru Liu

Photos courtesy of Zhehao Zhang

24 Aug 2023