02 Jul 2015

Understanding the present and future paths of the world’s two largest economies - China and the United States – is imperative in today’s global economy.

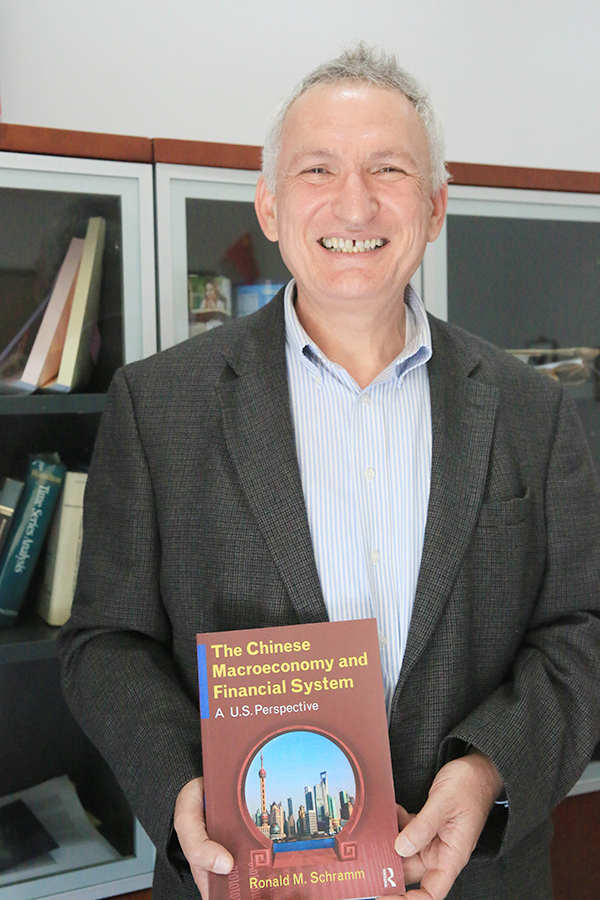

In this regard, PhD Programme Director of the International Business School Suzhou (IBSS) at Xi’an Jiaotong-Liverpool University, Associate Professor Ron Schramm, has filled a gap in the current literature with his new book The Chinese Macroeconomy and Financial System: a US Perspective (Routledge, April 2015).

Different from more traditional economics books about the Chinese economy that take an institutional or historic approach, Schramm’s text book looks at the economy as it is today using contemporary tools from macroeconomics, finance, accounting and even management to help explain the Chinese economy; he takes literally the notion that China is run like a company.

“The reason why I wrote this book is because I believe there is a need for better understanding the Chinese economy,” Professor Schramm said. “In my own country, the United States, the average university student has a very limited knowledge of the Chinese economy so I am trying to convey a message here about what the Chinese economy is really like and its financial system.”

Professor Schramm put his new textbook to the test on 40 senior students at IBSS who told him that he had taught them things about the Chinese economy that they never really understood or knew. He said, “I was thrilled by that because I thought if Chinese students don’t have a good understanding of their own economy then how much can we expect non-Chinese students to understand it. This text book is a way of understanding the Chinese economy by way of comparison with the world’s other major economy – the United States.”

Professor Schramm identifies four key drivers for the Chinese economy that make it unique and help explain its current and future performance. Unsurprisingly, the first driver is China’s population. “The government has played a role in how that population grows with the one-child policy and now there is the introduction of the two-child policy so I see these as key developments in terms of their impact on economic growth,” he said.

“The second key factor is China’s high savings rate and this has played a substantial role in terms of its impact of China’s level of investment - and by investment I mean plant, property, equipment and infrastructure.”

A third key driver was the role of the government, which plays an important role in the economy and has in the past 30 years in everything from experimenting with economic and financial reforms to labour markets to, of course, state ownership of companies, he added.

Finally what he considers as the central key driver for the Chinese economy is its labour force. “Its people and the flexibility and adaptability of its labour force are a major factor. I call the Chinese labour force and population at large the great economic shock absorber. There is no other population in the world that is so innovative and so responsive to economic shocks and to economic needs and that certainly adds a lot of flexibility and in turn stability to the Chinese economy,” concluded Schramm.

He said no other country could imitate the adaptability of Chinese the labour force “It is just not feasible – it’s a different culture and there is a different driving force. I think that other countries have their own solutions to economic shocks and China, in fact, will have to look more and more towards those other kinds of solutions as the population growth and labour force flexibility become less significant key drivers,” said Professor Schramm.

Professor Schramm said that there were a multitude of future opportunities for China because the economy was transforming and what government officials would call the internal imbalances were being rebalanced; with change came many opportunities. Many of these opportunities would be seized by Chinese but there would be some areas where foreign expertise could be of use.

“In the future, consumption will become a more important part of the economy and investment will become less important part of the economy – that is inevitable. I think almost anyone will agree with that forecast,” he said.

Consumption will rise but it will not look like the consumption we are used to in the West. It is going to be consumption in more service-related areas and, in particular, health care, education and travel. All these are technically forms of consumption in the GDP statistics but, when you think about it. The reality is that items like education are actually investments in people even though they are measured as consumption.

Professor Schramm added that on the financial side there would be a multitude of opportunities. Most Chinese held their wealth in money and cash in banks and they were looking for ways to diversify their portfolio.

“Additionally, in a more global context, China still holds most of its wealth globally in terms of U.S. treasury bills so, as that wealth is moved into other assets, it is another opportunity for global diversification. All of these are great opportunities of historical magnitude,” concluded Professor Schramm.

“Additionally, in a more global context, China still holds most of its wealth globally in terms of U.S. treasury bills so, as that wealth is moved into other assets, it is another opportunity for global diversification. All of these are great opportunities of historical magnitude,” concluded Professor Schramm. The audience for The Chinese Macroeconomy and Financial System: a US Perspective are Master’s students or final year students in university. It is an advanced text book in terms of tools needed to understand an economy and the depth that is goes into for the Chinese economy. It is suitable for students who want to get a Master’s in economics, business or in international affairs.

Morgan Stanley chairman and CEO, Mr James P. Gorman, praised the textbook, saying, “The Chinese Macroeconomy and Financial System: a U.S. Perspective combines the nuanced insight of a decades-long expert in China with fundamental analysis of the unique demand, growth and policy dynamics that have driven its rise and recast the global landscape. This is a comprehensive and highly relevant work that will prove equally useful to academics, business professionals and policymakers for years to come."

Professor Ron Schramm continues his research related to China, currently examining firm size distribution of investment banks in China. At a broader level, he is interested in applying tools from finance to macroeconomics questions – a field he describes as “Macrofinance.”

02 Jul 2015